Introduction

When people hear about ultra-wealthy families, the conversation often jumps straight to numbers. Billions here, rankings there, and a quick comparison to the latest tech mogul. But real generational wealth doesn’t work like a lottery ticket. It builds slowly, spreads quietly, and reshapes itself across decades.

- Introduction

- Where the Bronfman Story Begins

- Building Wealth Through Strategic Industry Choices

- Expansion, Adaptation, and Calculated Risk

- The Role of Family Governance in Wealth Preservation

- Diversification Beyond the Original Core

- Public Influence and Private Decision Making

- A Snapshot of the Bronfman Wealth Framework

- Philanthropy and Social Responsibility

- How Generational Wealth Evolves Over Time

- The Bronfman Family Net Worth in Context

- Media Attention and Public Curiosity

- Lessons Hidden Inside Large Fortunes

- Myths Around Billionaire Families

- The Balance Between Privacy and Transparency

- What Net Worth Really Represents

- Frequently Asked Questions About Bronfman Family Net Worth

- Conclusion

The story behind the Bronfman name fits that pattern perfectly. Instead of sudden fame, it’s a tale of calculated risk, timing, and long-term strategy. This article explores the background, evolution, and meaning behind the bronfman family net worth, focusing less on hype and more on how influence and capital intertwine over generations.

Where the Bronfman Story Begins

Every financial empire starts somewhere, often far from luxury. The Bronfman family’s rise didn’t begin with inherited millions. It began with opportunity, movement, and an ability to see potential where others didn’t.

Early decisions laid the groundwork for everything that followed. These weren’t flashy moves, but practical ones that aligned with economic shifts of the time. The foundation mattered more than immediate recognition.

Building Wealth Through Strategic Industry Choices

Wealth doesn’t grow in a vacuum. It grows in industries that scale, adapt, and survive disruption. One of the key factors in this family’s rise was entering markets with long-term demand.

Instead of chasing trends, the focus stayed on durable business models. That patience allowed value to compound, even when economic conditions fluctuated.

Expansion, Adaptation, and Calculated Risk

Growth brings complexity. As operations expanded, so did the need for structure, leadership, and adaptability. Decisions became less about survival and more about sustainability.

Calculated risk played a major role here. Not reckless bets, but informed moves backed by research and timing. That balance kept momentum steady without overexposure.

The Role of Family Governance in Wealth Preservation

Before diving into specifics, it’s important to understand that family wealth isn’t just financial. It’s organisational. Clear governance structures help prevent fragmentation and misalignment over time. Without them, even vast fortunes can erode quickly.

- Defined roles help reduce internal conflict

- Shared vision supports long-term stability

These elements often matter more than raw income.

Diversification Beyond the Original Core

As wealth grew, diversification became essential. Relying on a single industry leaves even powerful families vulnerable. Expanding into new areas spreads risk and opens fresh opportunities.

Diversification also reflects evolution. Each generation brings new interests, values, and perspectives that influence where capital flows next.

Public Influence and Private Decision Making

High-net-worth families walk a fine line between visibility and privacy. Public recognition brings influence, but it also invites scrutiny.

Much of the most impactful decision-making happens quietly. Strategic investments, partnerships, and philanthropy rarely make headlines, yet they shape outcomes just the same.

A Snapshot of the Bronfman Wealth Framework

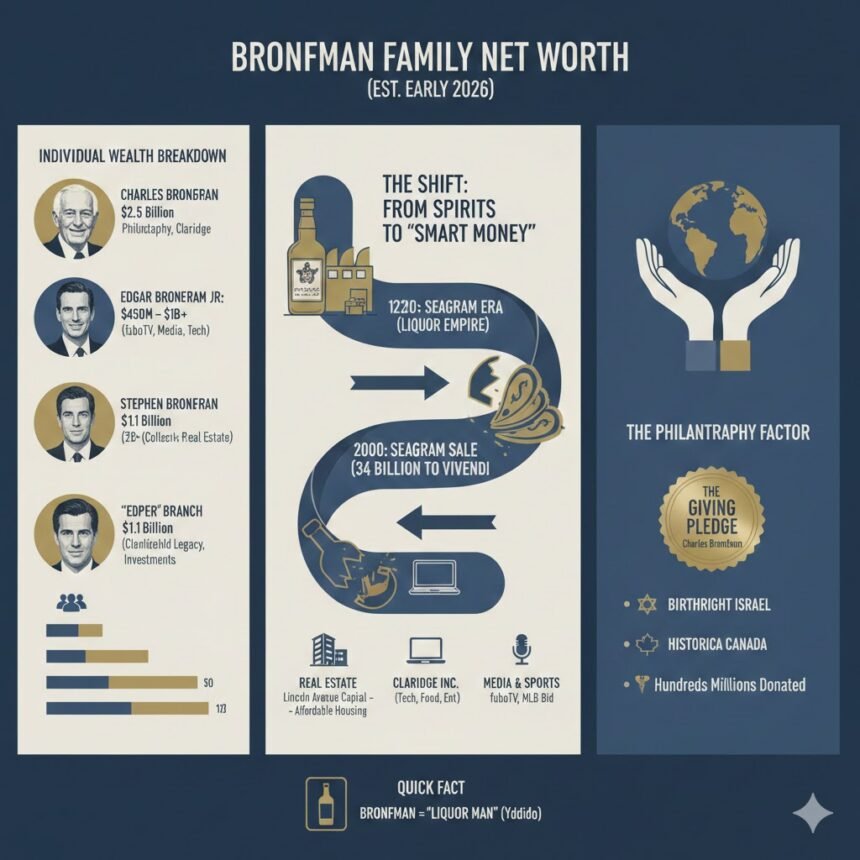

The Bronfman family’s wealth has evolved over generations, spread across investments, businesses, and holdings. Here’s an overview of the estimated net worth of prominent family members:

| Family Member | Estimated Net Worth | Notes |

|---|---|---|

| Edgar Bronfman Sr. | $2.5 billion | Former Seagram CEO, passed in 2013; estate managed by heirs |

| Edgar Bronfman Jr. | $1 billion | Former Warner Music CEO; diversified investments |

| Samuel Bronfman | $1.5 billion | Founder of Seagram empire; legacy assets continue |

| Clare Bronfman | $100 million | Entrepreneurial ventures and philanthropy |

| Matthew Bronfman | $2 billion | Investments in tech and private companies |

| Phoebe Bronfman | $500 million | Real estate, trusts, and investments |

Note: All figures are estimates based on public records, media reports, and historical business holdings. Net worth can fluctuate with markets and private investments.

Philanthropy and Social Responsibility

As wealth grows, expectations shift. The question becomes less about accumulation and more about impact. Philanthropy plays a meaningful role here.

Rather than impulsive giving, structured philanthropy allows for measurable outcomes. It reflects values while reinforcing long-term influence beyond business.

How Generational Wealth Evolves Over Time

Wealth doesn’t stay static. Each generation inherits not just assets, but responsibility. Some expand the legacy, others redefine it.

Education, values, and adaptability determine whether wealth grows or dissipates. History shows that longevity requires intention, not entitlement.

The Bronfman Family Net Worth in Context

When discussing the bronfman family net worth, context matters. It’s not just a snapshot number, and it’s not concentrated in a single account.

Assets are spread across businesses, investments, and long-term holdings. That structure makes the wealth resilient, even when individual markets fluctuate.

Media Attention and Public Curiosity

Public curiosity often fixates on rankings and comparisons. While understandable, that lens misses the bigger picture.

True financial influence isn’t always visible. It shows up in boardrooms, cultural institutions, and long-term initiatives rather than headlines.

Lessons Hidden Inside Large Fortunes

There’s more to learn from how wealth is managed than how large it is. Discipline, patience, and adaptability tend to appear repeatedly in long-lasting fortunes.

Short-term thinking rarely survives across generations. Long-term planning, on the other hand, compounds quietly.

Myths Around Billionaire Families

Some believe wealthy families never face risk. Others assume success guarantees harmony. Neither is true. Market shifts, internal disagreements, and public pressure affect everyone. What sets enduring families apart is how they respond, not whether challenges appear.

The Balance Between Privacy and Transparency

Complete secrecy creates suspicion, while total transparency invites intrusion. Finding balance matters. Careful communication allows families to maintain boundaries while participating responsibly in public life.

What Net Worth Really Represents

Net worth is often misunderstood as cash on hand. In reality, it represents accumulated value across time, decisions, and structure. For families like this, it’s more accurate to think in terms of ecosystems rather than bank balances.

Frequently Asked Questions About Bronfman Family Net Worth

What does bronfman family net worth actually include?

It includes business holdings, investments, and long-term assets rather than liquid cash alone.

Is the wealth controlled by a single individual?

No. It’s typically distributed across family structures and governance systems.

Does net worth change over time?

Yes. Market conditions, investments, and diversification cause constant fluctuation.

Is philanthropy part of the family’s financial strategy?

Yes. Structured giving plays a role in legacy and influence.

Why is there so much curiosity about this family?

Because their wealth reflects long-term strategy rather than sudden success.

Conclusion

The story behind the bronfman family net worth isn’t just about scale. It’s about endurance. Built through strategic choices, preserved through governance, and reshaped by each generation, it represents more than financial success. It reflects a long view of wealth as responsibility, influence, and legacy. In a world obsessed with quick wins, that mindset quietly stands apart.